workers comp taxes for employers

Tips commissions and fees benefits and stock options. Under the Internal Revenue Code these payments are not excluded benefits but a continuation of paid wages.

Workers Compensation And Taxes James Scott Farrin

If necessary seek medical attention immediately.

. Employers must report and pay both fees using. Payment is due by the last day of the month following the end of the quarter. Read the public ruling on workers compensation payments PTA015.

Non-taxable compensation payments include compulsory. 2 But in California the average premium in 2021 is 156 per 100 of payroll. If employees pay these expenses themselves they may be able to receive tax-free reimbursements from their employers.

For tax years beginning after 2017 reimbursement you receive from your employer for the purchase repair or storage of a bicycle you regularly use for travel between your residence and place of employment must be included in your gross income. Who to contact for workers compensation advice and help. So if you receive above 2400 which is 80 of 3000 then the SSDI will 2400.

Social Security has a wage base limit which for 2022 is 147000. The employer must obtain a workers compensation insurance policy. This can happen sometimes when an employee joins a company during a tax year ie.

124 to cover Social Security and 29 to cover Medicare. There are a few scenarios where taxes may be due. In general the tax law allows employers to pay various business expenses for employees without creating taxable income to those employees.

Workers compensation includes payments to employees to cover their. If desired file a claim for Workers Compensation benefits as specified in IRM 680016 Process Overview and Claim Forms. Workers comp is a type of insurance.

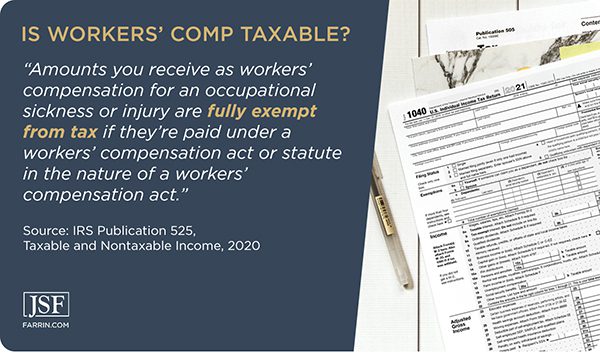

You must notify your manager of your claim. Workers comp benefits arent considered earned income like your work wages so payments for workers compensation arent typically subject to either federal or state taxes. 1099 contractors receive a 1099 each year.

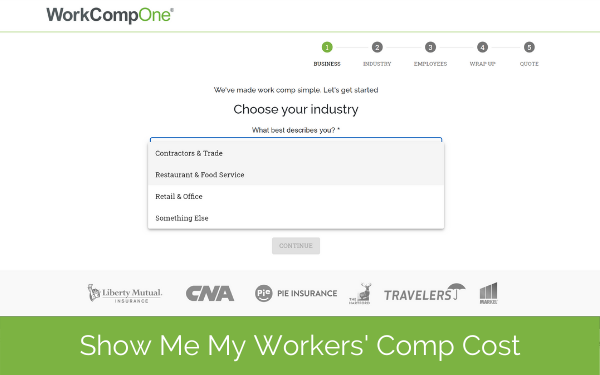

1 On average employers will pay 1 per 100 of payroll for workers comp in 2021. Made because of that individuals or another persons incapacity for paid work. There are two ways to provide this coverage depending on the financial resources of your business.

Therefore FICA can range between 153 and 162. The taxable part of your disability income is the reduction. As an employer you would not pay employee taxes on a 1099 subcontractor because they are not an employee.

The fee for the employer is 230 times the number of covered employees working on the last day of the quarter. If the tax payable to the BIR and the tax withheld from an employees salary do not align the employer will have to review why this is the case and. For employees earning more than 200000 the Medicare tax rate goes up by an additional 09.

Employees receive a W-2 from their employer each year and the employer pays taxes and benefits on their behalf. In most states insurers are allowed to charge at their own discretion against the advised rates published by the states rating agency. If your offset is 150 that is the amount that may be taxable.

You can ask different workers compensation insurance providers for their rates by class code. All payments your business makes to employees for work are taxable including salaries and wages including overtime. The fee for covered employees working on the last day of the quarter is 200.

This 153 federal tax is made up of two parts. The IRS requires taxpayers to count their workers compensation benefits as income if they continue to work modified or light-duty shifts while receiving reduced weekly benefits. It covers the employer and the employees.

Workers compensation is typically one of those legally required employee benefits. Wages while theyre not fit for work medical expenses and rehabilitation. The long and short of it is no.

You see the way a true 1099 worker operates is like a freelancer. This is down from 105 in 2020. Any benefits paid to survivors of workers comp death benefits also shouldnt have to pay taxes on those benefits.

Withholding does not apply to payments made by an insurer to the owner of a relevant policy. Employee gross income is taxable to the employee including overtime pay for non-exempt employees and certain lower-income exempt employees. Generally employers must provide workers compensation industrial insurance coverage for their employees and other eligible workers.

For example rates in Oregon are expected to drop in 2021 for the eighth-straight year. Here are some more details. Its the insurance company that ultimately pays out for lost wages medical expenses retraining costs and settlements.

Employees must pay income taxes on their wages. Workers comp is not deducted from payroll taxes. The employer is 100 percent responsible for paying premiums to an insurance company.

The rate will be given in dollars and cents for each 100 of payroll for each class code. You need to withhold when you make a compensation sickness or accident payment to an individual if it is both. If the compensation that WorkCover Queensland pays you is less than the wages you would normally pay the injured employee any difference that you pay - make up pay - is taxable.

It is preferred that you e-file your claim using the Safety and Health Information Management System SHIMS. Calculated at a periodical rate. Employers in each state or territory have to take out workers compensation insurance to cover themselves and their employees.

The employee does not work the full tax year but is in fact taxed as if they were employed for the entire year. If your pre-injury income for example was around 3000 a month then you cannot exceed 80 of that total with your SSDI and WC income. Most businesses participate in the states workers compensation program.

If you are the 1099 subcontractor you would pay self-employment taxes at tax time as you are operating as a self-employed individual. Workers compensation rates can vary greatly from state to state.

How Long Can A Workers Comp Claim Stay Open Canal Hr

Is Workers Comp Taxable Hourly Inc

Workers Compensation And Taxes James Scott Farrin

Is Workers Comp Taxable Workers Comp Taxes

5 Requirements For Workers Compensation Eligibility

Workers Compensation Insurance Overview Amtrust Financial

How To Create A New Hire Checklist Employee Handbook Template Employee Onboarding Employee Handbook

Are Workers Comp Benefits Adequate Legal Talk Network

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Permanent Disability Pay In California Workers Comp Cases 2022

Is Workers Comp Taxable In Hickory Nc

What Is Workers Compensation Article

How To Calculate Workers Compensation Cost Per Employee

What Wages Are Subject To Workers Comp Hourly Inc

How To Calculate Workers Compensation Cost Per Employee Pie Insurance